Sorry Tenants, the Velvet Rope Just Got Tighter

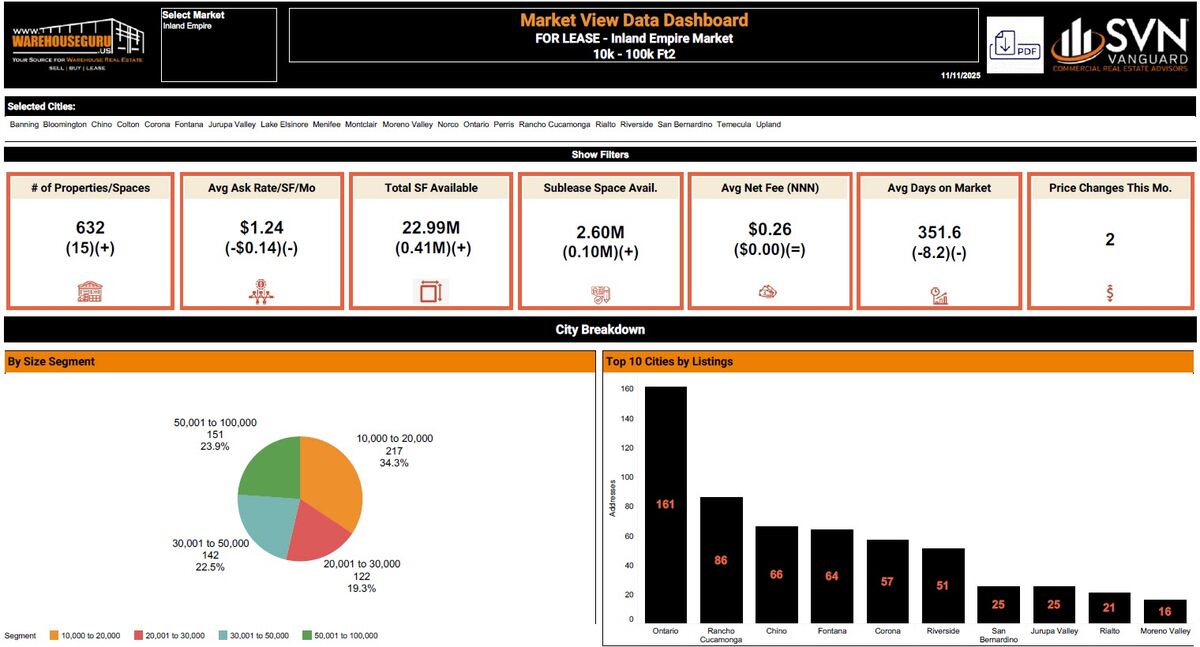

Owners, pop the champagne and hide the For-Lease signs—your buildings are officially the hottest ticket in town. As of November, the IE (10k-100k sf) is down to a manageable 632 listings—that’s 15 fewer competitors at your door than last month.

Total availability? An anorexic 23 million sf (+410k sf, whoop-de-doo), equating to 3.8 months of supply. Translation: tenants are tripping over each other faster than Black Friday shoppers at an Ontario Outlet mall.

Asking rates took a dainty 11% nap to $1.24 NNN, but let’s not kid ourselves—that’s just the market politely coughing before it roars back.

Ontario’s 161 listings still average $1.29/sf like they’re too cool to discount, while Fontana ($1.25) and Rancho Cucamonga ($1.31) are basically flexing in the mirror.

Days-on-market plunged 8.2 to 351.6, meaning your phone starts smoking before the paint dries. Sublease noise crept up to 2.6M sf, but that’s still just 11% of inventory—tenants dumping space, not owners.

Bottom line, landlords: Your building isn’t “on the market,” it’s on a waiting list. Consider asking rates another +$.05, maybe some free rent or minor concessions, and make them bring cupcakes to the tour. The IE isn’t softening—it’s doing burpees while tenants gasp for air. Q1 2026? You’ll name your price, and they’ll thank you for it.

(Courtesy of Warehouse Guru—turning your vacancy into their anxiety since forever.)

Your Warehouse Just Became a Unicorn NFT—And Everyone Wants to Mint It

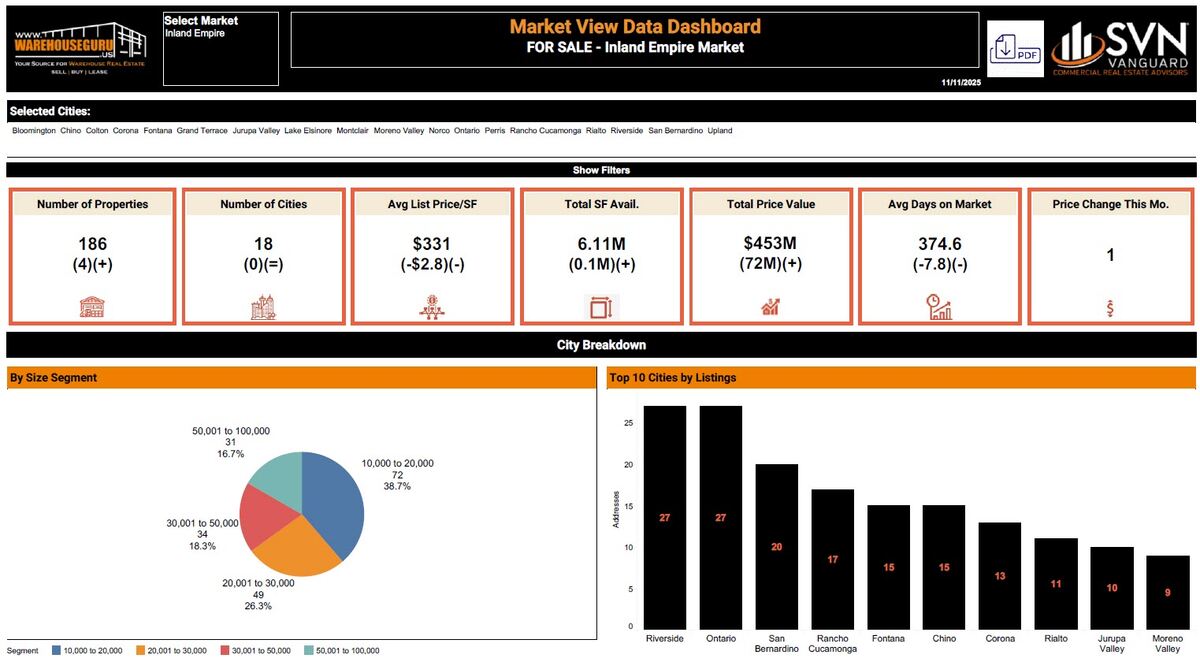

Dear Owners, repeat after me: “I shall not sell cheap. I shall not sell cheap.” Because as of November, the IE sales market is serving pure catnip: only 186 properties on the menu (+4, still rarer than a quiet 91-freeway morning) with a microscopic 6.11M sf available. That’s barely enough to fill one Amazon “last-mile” sneeze.

Average list price? A smug $331/sf (-$2.80, basically rounding error). Low end? $157.72/sf—cute, but that’s the distressed cousin nobody invites to Thanksgiving.

Riverside and Ontario tied at 27 listings each, yet Riverside owners are flexing $295/sf averages while Ontario’s cool kids demand $314/sf. San Bernardino says “hold my energy drink” at $341/sf—because nothing screams value like a 909 zip with armed guards included. Days-on-market? Plummeted 7.8 to 374.6—your building is moving faster than Prime two-day shipping. Total dollar volume spiked to $453M, meaning buyers are panic-scrolling Loopnet like it’s Ticketmaster for Taylor Swift.

Owner power move: If your 30k-50k sf gem isn’t listed north of $340/sf with glossy drone shots and a fresh roof, you’re basically giving away Bitcoin in 2012. Cap rates are compressing faster than a TikTok dance trend—lock in that 4-handle before buyers start bringing suitcases of cash and emotional support dogs to closing.

Bottom line: The IE isn’t a market, it’s a runway—and your asset just got upgraded to first class. Price it like the rare Pokémon it is, because 2026 buyers are already camping out with lawn chairs.

(Courtesy of Warehouse Guru—turning your equity into their FOMO since yesterday.)