In the quiet solitude of Ernest Hemingway's "The Old Man and the Sea," Santiago, an aged fisherman, faces the relentless and unpredictable forces of the ocean. His journey, much like today's Southern California commercial real estate market, is one marked by profound struggle and the pursuit of a stubborn and elusive success. As I delve into Santiago’s epic battle with the great marlin, I see reflections of our own industry’s current challenges—slow market velocity, fluctuating prices, anemic demand, and an ongoing correction.

The Vast Ocean: A Market in Flux

Picture Santiago, venture out into the Gulf Stream, determination woven into every weathered fiber of his character. For those in real estate, the market we traverse today is like that vast expanse of water, teeming with potential yet fraught with uncertainty.

From our Data Dashboard (below), KPIs reveal that Southern California's market is seeing an enigmatic fluctuation, with average list prices per square foot ranging dramatically across regions like Riverside ($300.44) to Irvine’s highs of $425.31 and lease rates averaging from $1.42 - $1.60psf across SoCal.

The number of properties has risen to a bustling +1000 properties/spaces for lease and +300 for sale listings across the southland.

The Patience of the Fisherman: An Enduring Pursuit

Just as Santiago teaches us the value of patience through his long days at sea, so too must industry professionals employ patience as their guiding compass. With market demand anemic and properties experiencing an average of 277 for lease & 303 for sale days on the market, perseverance becomes more critical than ever. Santiago's unyielding resolve to maintain his course, despite scant returns, mirrors the steadfastness required to navigate this period of market correction and fluctuating lease rates.

A Sea of Change: Adapting Strategies

Santiago’s venture is not just about the catch but also about adapting to the changing tides and the formidable marlin at the end of his line. Today’s real estate market demands a similar flexibility, within dustries needing to pivot strategies. Whether it’s leveraging technology to enhance digital presence or reevaluating pricing structures, lease concessions and the (20%) price changes observed this month necessitate an adaptive approach. For instance, the average asking lease rate per square foot in Orange County fluctuates between $0.95 and ~$5.43, urging lessors, tenants and brokers to stay nimble and adjust quickly.

Respecting the Unknown: The Real Estate Landscape

In navigating this landscape, respect for market dynamics is crucial. Santiago faced the elements with reverence, much like professionals respecting economic trends and demand-supply imbalances must. An average list price per square foot, like Rancho Cucamonga’s $367.86psf, highlights the diverse and often unexpected nature of property valuation. The highs and lows echo Santiago’s victories and defeats along the shore’s edge.

Net Gains: Redefining Success

Santiago’s journey back to his village with the marlin's skeleton highlights a critical truth—success is not always measured by tangible gain. In real estate, redefining success might mean forging relationships, maintaining resilience in downturns, or honing strategies for leaner times. As prices and lease rates find equilibrium, professionals must consider broader wins beyond immediate financial returns, fostering long-term partnerships and community growth.

Final Reflections: Charting a New Course

As Santiago returns, burdened yet enlightened by his odyssey, we too are reminded of the cyclical nature of markets. The ~37m and ~9m total square footage available speaks to opportunities awaiting exploration once the seas settle. With an eye on past lessons and a heart ready for change, we stand equipped to chart fresh courses.

"The Old Man and the Sea" shares timeless wisdom—patient endurance, strategic adaptation, and embracing the journeyitself. As the Southern California market ebbs and flows, we can draw inspiration from Hemingway’s tale to navigate treacherous waters, seeking not just survival but thriving in the wake of challenge. Just like Santiago, we too can look forward to the breaking sunrise, confident in the tide's promise of a new day.

Cheers and go make it happen. Let me know if we can assist....

Cameron

DATA DASHBOARDS! - Our team tracks for sale or lease listings ranging from -10K -100k sqft daily and shares this info via our Data Dashboards. These detail Key Performance Indicators for Available For Sale and Lease Warehouse / Industrial property in SoCal. Good Info and Data for both Lessors & Tenants…reach out for a customize report by city, size etc.

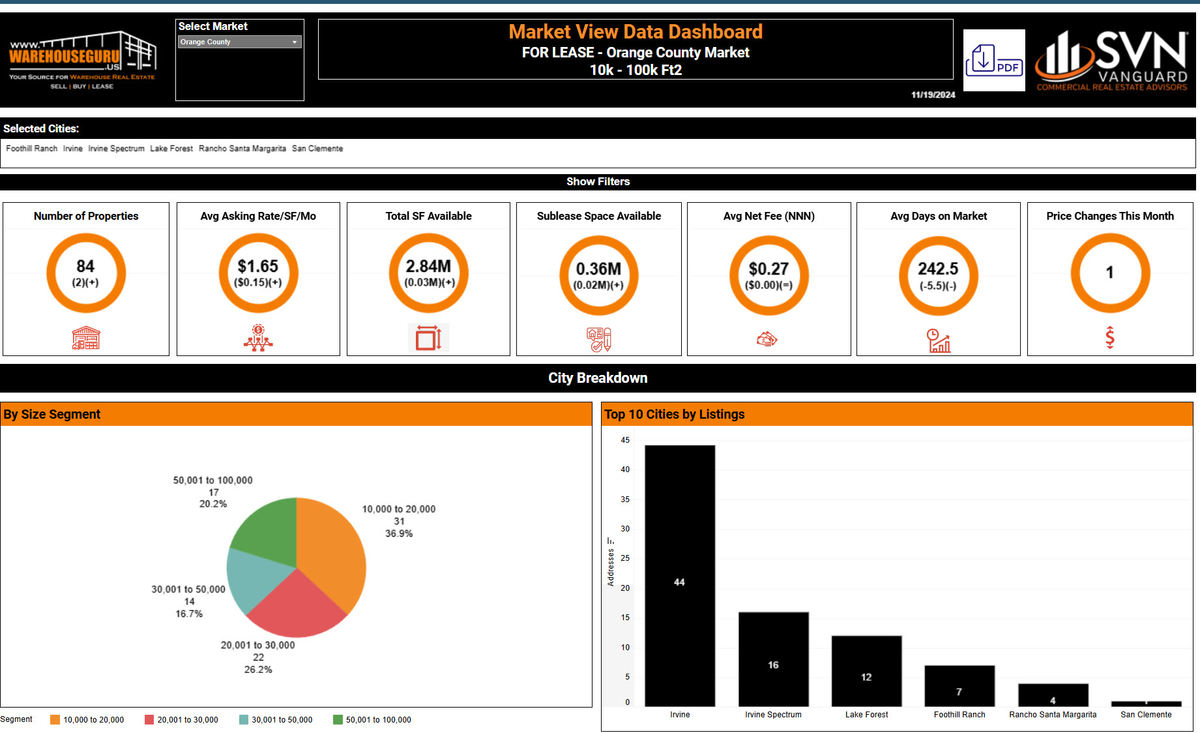

DATA DASHBOARD KPI’s: Orange County

FOR LEASE: KPI HIGHLIGHTS

- ~408 Properties/Spaces Available

- ~13.48m Sqft Available

- $1.60 Avg Asking Lease Rate

- ~2.2mm Sqft of Sublease space

- 261 Avg Days on Market

- Top 3 Markets w/most availability: Anaheim, Santa Ana, Irvine

- (177) 10k -20k sqft & (81) 20k-30k sqft & (65) 30k-50k Sqft & (85) 50k-100k

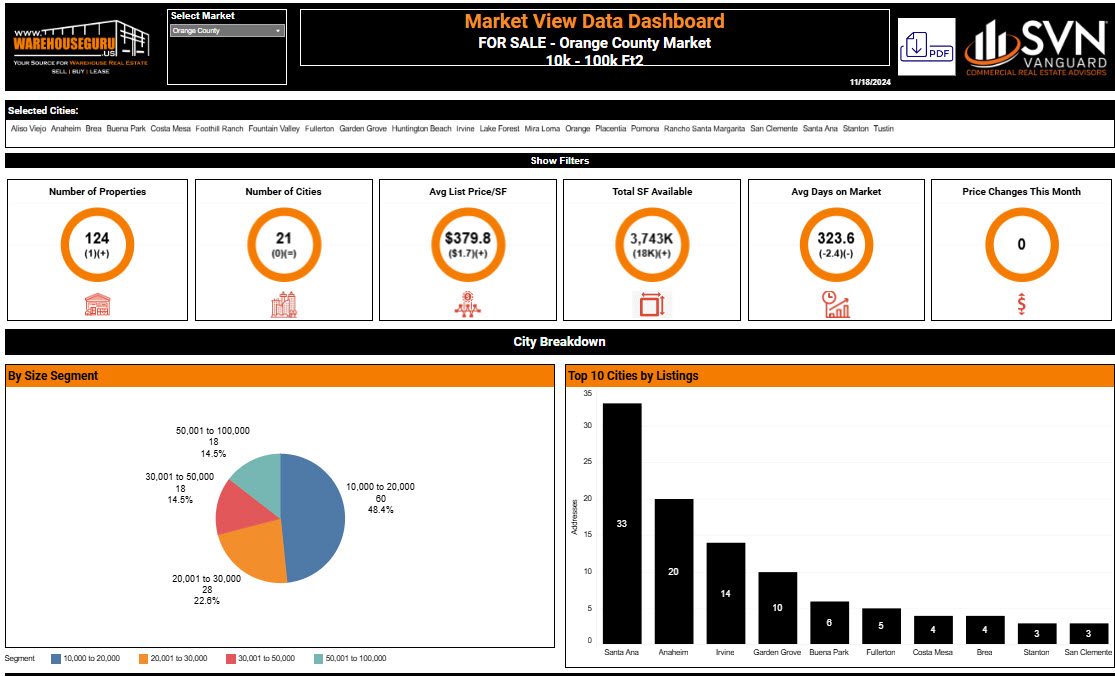

FOR SALE: KPI HIGHLIGHTS

- ~124 Properties for Sale

- $379psf Avg Asking Price

- ~3.74m Sqft Available

- ~323 Avg Days on Market

- Top 3 Cities w/Availability - Santa Ana, Riverside, Irvine

- (60) 10k -20k Sqft & (28) 20k-30k sqft & (18) 30k-50k Sqft & (18) 50k-100k

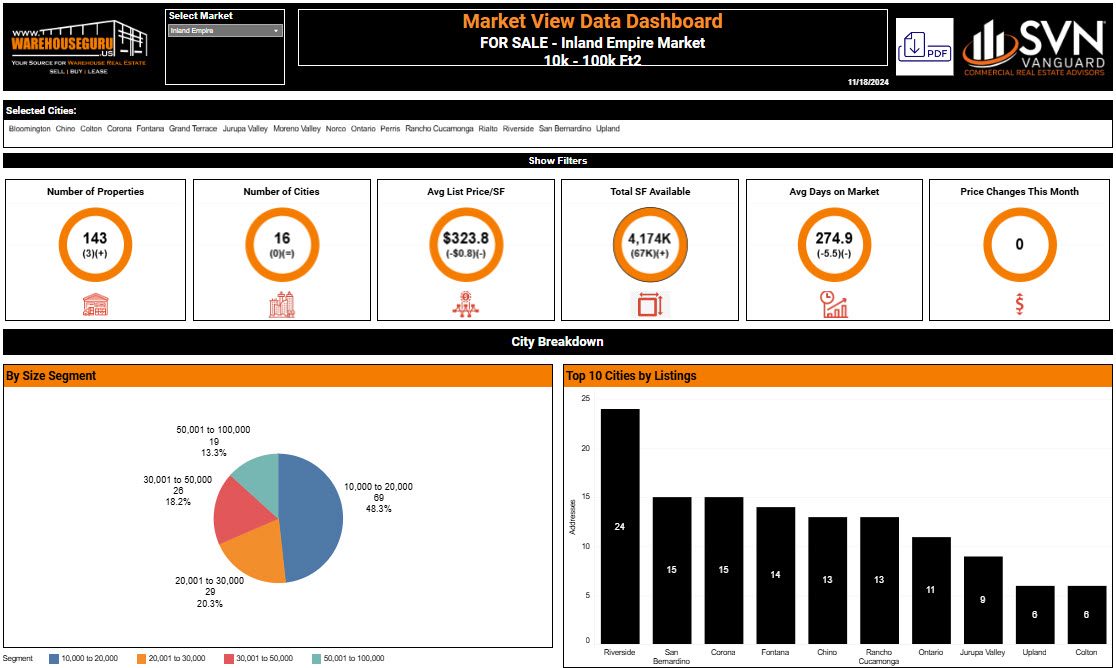

DATA DASHBOARD KPI’s: Inland Empire

FOR SALE: KPI HIGHLIGHTS

- ~143 Properties for Sale

- $323psf Avg Asking Price

- ~3.17m Sqft Available

- ~274 Avg Days on Market

- Top 3 Cities w/Availability - Riverside, San Bernardino, Corona

- (69) 10k -20k Sqft & (29) 20k-30k sqft & (26) 30k-50k Sqft & (19) 50k-100k

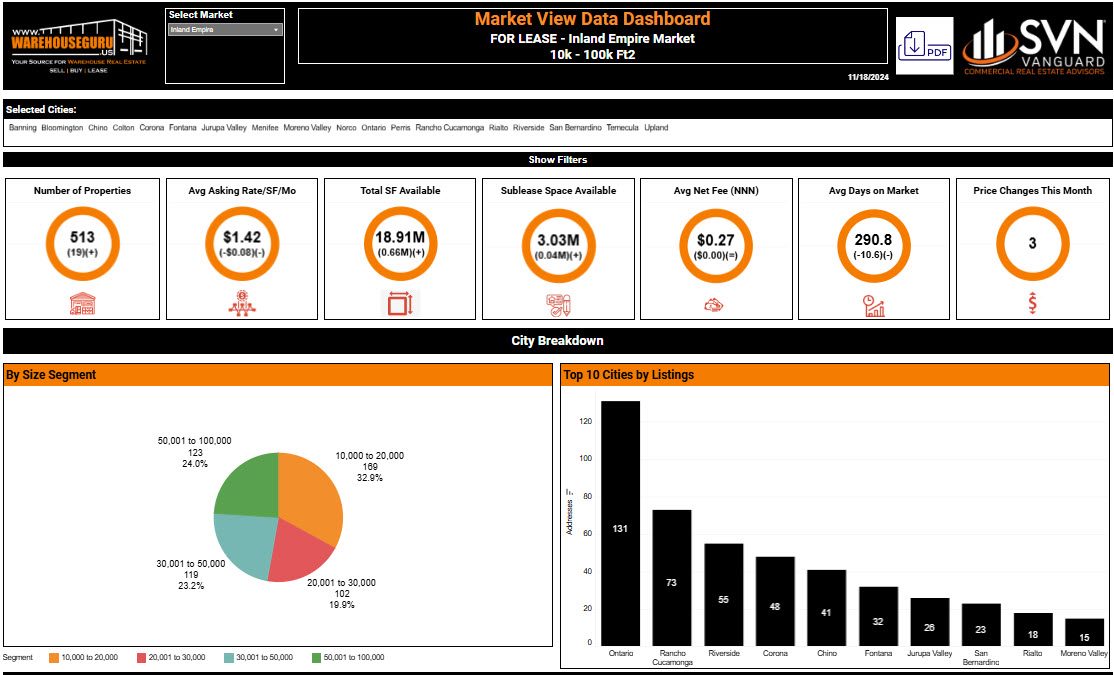

FOR LEASE: KPI HIGHLIGHTS

- ~513 Properties/Spaces Available

- ~18.91m Sqft Available

- $1.42 Avg Asking Lease Rate

- ~3.03mm Sqft of Sublease space

- 290 Avg Days on Market

- Top 3 Markets w/most availability: Ontario, Rancho Cucamonga, Riverside

- (169) 10k -20k sqft & (102) 20k-30k sqft & (119) 30k-50k Sqft & (123) 50k-100k

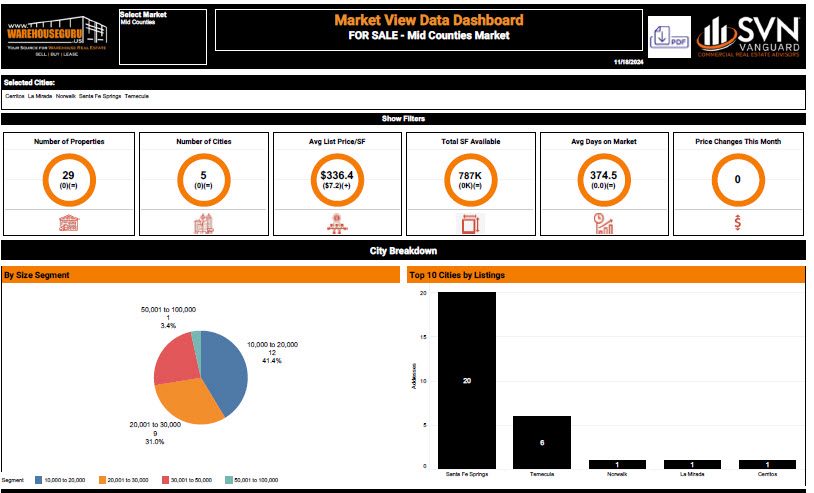

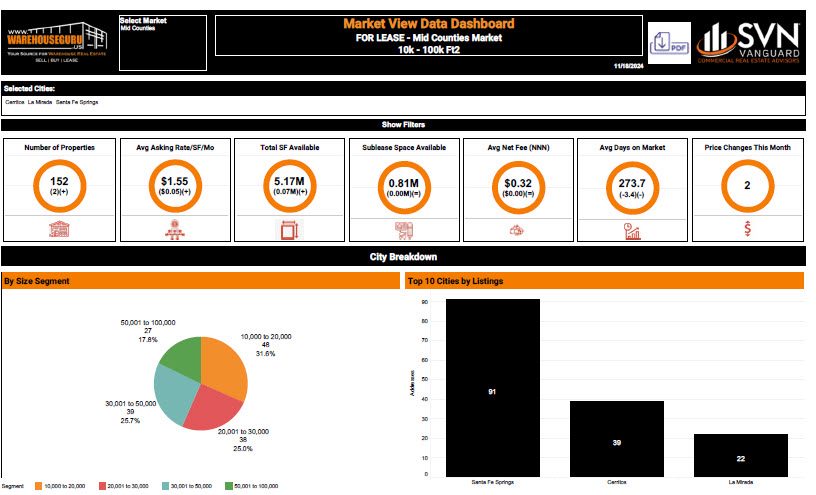

DATA DASHBOARD KPI’s: Mid Counties

FOR SALE: KPI HIGHLIGHTS

- ~143 Properties for Sale

- $323psf Avg Asking Price

- ~3.17m Sqft Available

- ~274 Avg Days on Market

- Top 3 Cities w/Availability - Riverside, San Bernardino, Corona

- (69) 10k -20k Sqft & (29) 20k-30k sqft & (26) 30k-50k Sqft & (19) 50k-100k

FOR LEASE: KPI HIGHLIGHTS

- ~513 Properties/Spaces Available

- ~18.91m Sqft Available

- $1.42 Avg Asking Lease Rate

- ~3.03mm Sqft of Sublease space

- 290 Avg Days on Market

- Top 3 Markets w/most availability: Ontario, Rancho Cucamonga, Riverside

- (169) 10k -20k sqft & (102) 20k-30k sqft & (119) 30k-50k Sqft & (123) 50k-100k